Yesterday, the Consumer Financial Protection Bureau announced it is considering proposing rules that would ban consumer financial companies from utilizing mandatory arbitration agreements that prevent consumers from seeking redress through the court system.

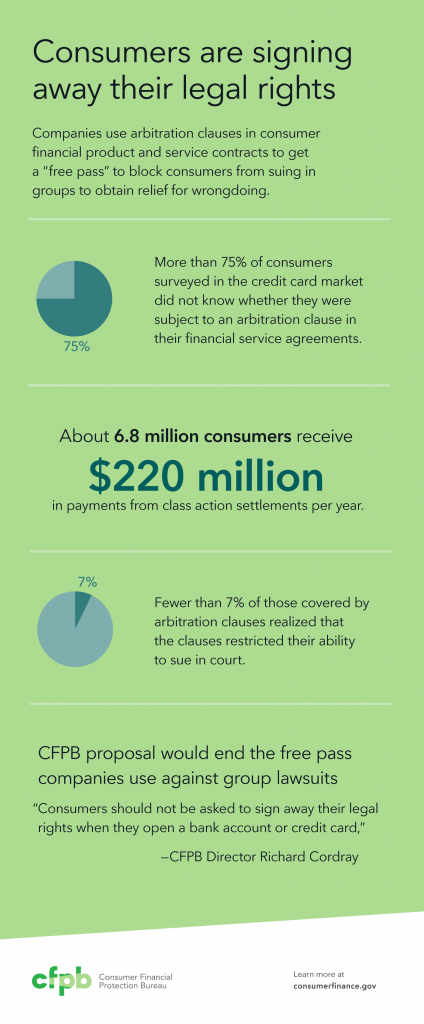

Most consumers do not see the mandatory arbitration language lurking in the fine print of contracts for standard consumer financial products such as credit cards or bank accounts. By signing these contracts, consumers waive their right to participate in class action law suits against companies. The companies in question can therefore avoid big refunds, and continue to perpetrate violations against consumer rights without being held accountable. The CFPB’s proposals under consideration would give consumers their day in court and deter companies from wrongdoing.

“Companies are using the arbitration clause as a free pass to sidestep the courts and avoid accountability for wrongdoing,” said CFPB Director Richard Cordray. “The proposals under consideration would ban arbitration clauses that block group lawsuits so that consumers can take companies to court to seek the relief they deserve.”

A report from the CFPB released earlier this year outlined the following:

SOURCE: CFPB Blog

What is Forced Arbitration?

Non-negotiable applications and agreements for payday and other short-term, high-interest loans include binding mandatory (or forced) arbitration clauses.

Forced arbitration clauses require that, if a dispute between a borrower and lender arise, the dispute must be resolved through binding arbitration, and cannot be settled in court.

Consumer advocates are particularly concerned with how these rules might impact payday lenders, who have used mandatory arbitration agreements to avoid accountability to consumers who were the victims of rights violations. The CFPB study found the following with regards to payday lenders and mandatory arbitration agreements:

-In a CFPB study sample, 99% of California and Texas payday storefronts used forced arbitration clauses.

-Almost 90% of the payday loan arbitration clauses also banned borrowers from participating in class actions against lenders.

-Only 1.5% of licensed storefronts did not use forced arbitration in their borrower contracts.

Other CFPB Findings

-Consumers rarely go to arbitration and even fewer go to arbitration for small-dollar loan disputes.

-Storefront payday loan arbitration clauses almost always were more complex and written at a higher grade level than the rest of the payday loan contract.

Court System Provides Compensation for Consumers and Accountability for Payday Lenders

-When borrowers are able to go to court and participate in class actions to enforce laws, they can recover millions of dollars illegally taken from them.

-But when payday borrowers are forced into individual arbitration, few can vindicate their rights, allowing illegal lending to continue unchecked.

Potential CFPB Solutions

-CFPB can offer a strong rule to protect consumers from predatory small-dollar lending, AND

-CFPB can offer a strong rule giving borrowers access to the court system by eliminating forced arbitration and restoring their ability to band together in class actions.

-Borrowers will be able to enforce (anticipated) payday regulations and other consumer protection laws.

Does the Court System Work Better for Consumers?

Class actions against payday lenders’ predatory practices serve the public by halting unjust practices and providing compensation to victimized borrowers. For example:

-In 2009, a North Carolina court struck down a forced arbitration clause and class action ban in payday contracts.

-The Advance America class action had 135,136 participants and settled for $18.8 million.

-Check ’N Go settled its case involving 118,906 class members. $8.8 million was available for class members.

-In Check Into Cash class action, $7.5 million was available for distribution to 109,000 class members.

Georgia Watch will continue to monitor the progress of the Consumer Financial Protection Bureau as they release a final proposed rule. To read the current outline of proposals, visit the CFPB website.

For more analysis, you can also visit:

National Consumer Law Center

Americans for Financial Reform